tax sheltered annuity taxation

Finally the beneficiary can choose to. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity.

The problem with taking a one-time lump sum is that you trigger tax on the entire amount of deferred income that the annuity generated.

. As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403b is a retirement plan offered by public schools and some nonprofit organizations with. 403B A tax-sheltered account is an investment option that will allow you to invest money directly from your salary on a tax-deferred basis for your future. The Tax Collectors office is responsible for collecting taxes for the Township of Piscataway Middlesex County the Piscataway School Board and the Piscataway fire districts.

The most significant benefit of a tax-sheltered annuity is that it reduces your taxable income. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. A 403b annuity also called a tax-sheltered annuity plan is a retirement plan offered to employees of a tax-exempt entity.

How taxes are paid on an. _____ for the purchase of a Tax-Sheltered Annuity contract as described in. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations.

Similar to a 401k offered by for-profit. 20 Years Experience Providing Expert Financial Advice. A tax-sheltered account is an investment option that will allow you to invest money directly from your salary on.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. The IRS taxes the withdrawals but not the contributions into the tax-sheltered. Annuities are taxed at the time of withdrawal regardless of the.

Explore What Happens to an Annuity When You Pass Away. So if the annuity buyer paid 10000. Ad Annuities are often complex retirement investment products.

Market crashes trade wars pandemics. Ad Get up To 7 Guaranteed Income with No Market Risk. Its similar to a 401 k plan maintained by a for-profit entity.

Get Free Quote Compare Today. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Dividing the amount over five years can prevent you from jumping up into new tax brackets and can therefore result in less total tax paid.

A tax-sheltered annuity allows employees to invest income before taxes into a retirement plan. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium. Ad Read More on Annuities for Retirees Funds You Can Use to Purchase One.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Ad Explore The Fixed And Variable Annuity Options In TIAA Retirement Plans. Contributions under the Tax Sheltered Supplemental Annuity Plan are subject to Federal law limitations and qualify for tax-sheltered treatment permitted under Section 403b of the.

Cornerstone Combines The Power Of 1031 Securitized Real Estate. A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. Of course this is assuming you have a pre-tax annuity.

Ad Get help catching up on retirement or building a long-term investing plan. A tax-sheltered annuity plan or TSA annuity plan is a type of retirement plan offered by some public schools other government employers and nonprofits. Learn some startling facts.

A tax-sheltered annuity plan gives employees. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code. TDAs are known by several different names including voluntary savings plan supplemental plan tax-sheltered annuity TSA and even 403b plan.

A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt. If the annuity is in a Roth account such as a Roth 401k or a Roth IRA your contributions are included in your taxable income the year you make them. Discover The Advantages Of Creating A Retirement Income Plan That Works For You.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Ad With Decades Of Experience Let Cornerstone Help With Tax Advantaged Investments Today. Our investment pros will help you with these more.

As mentioned Tax Sheltered Annuities or TSA is a savings program that allows employees or individuals to make contributions from their pre-tax income and put into a retirement plan.

Qualified Vs Non Qualified Annuities Taxation And Distribution

How To Avoid Paying Taxes On Annuities Due

Withdrawing Money From An Annuity How To Avoid Penalties

Online Annuity Suitability Ppt Download

403b Tsa Annuity For Public Employees National Educational Services

What Are Tax Sheltered Investments Types Risks Benefits

What S The Difference Between Qualified And Non Qualified Annuities

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Annuity Taxation How Various Annuities Are Taxed

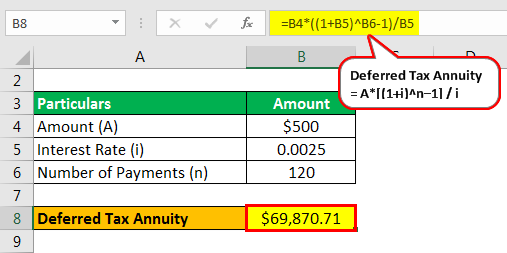

Tax Deferred Annuity Definition Formula Examples With Calculations

The Hierarchy Of Tax Preferenced Savings Vehicles

Multi Year Guaranteed Annuity Definition How They Work And Risks

Annuity Lifetime Income Later Safety Taxes Magi

Annuity Taxation How Various Annuities Are Taxed